Table of Content

It is important to note that VA Home Loans are provided by private lenders, such as banks and mortgage companies. However, because the VA guarantees a portion of the loan, they can offer more favorable terms for the loan. The VA funding fee is a percentage of the total loan amount, paid at closing, which enables the VA home loan program to be self-sustaining. One of the big issues with a foreclosure is the hit credit scores can take. If scores fall too far, home buyers will have a difficult time finding a lender to approve their mortgage.

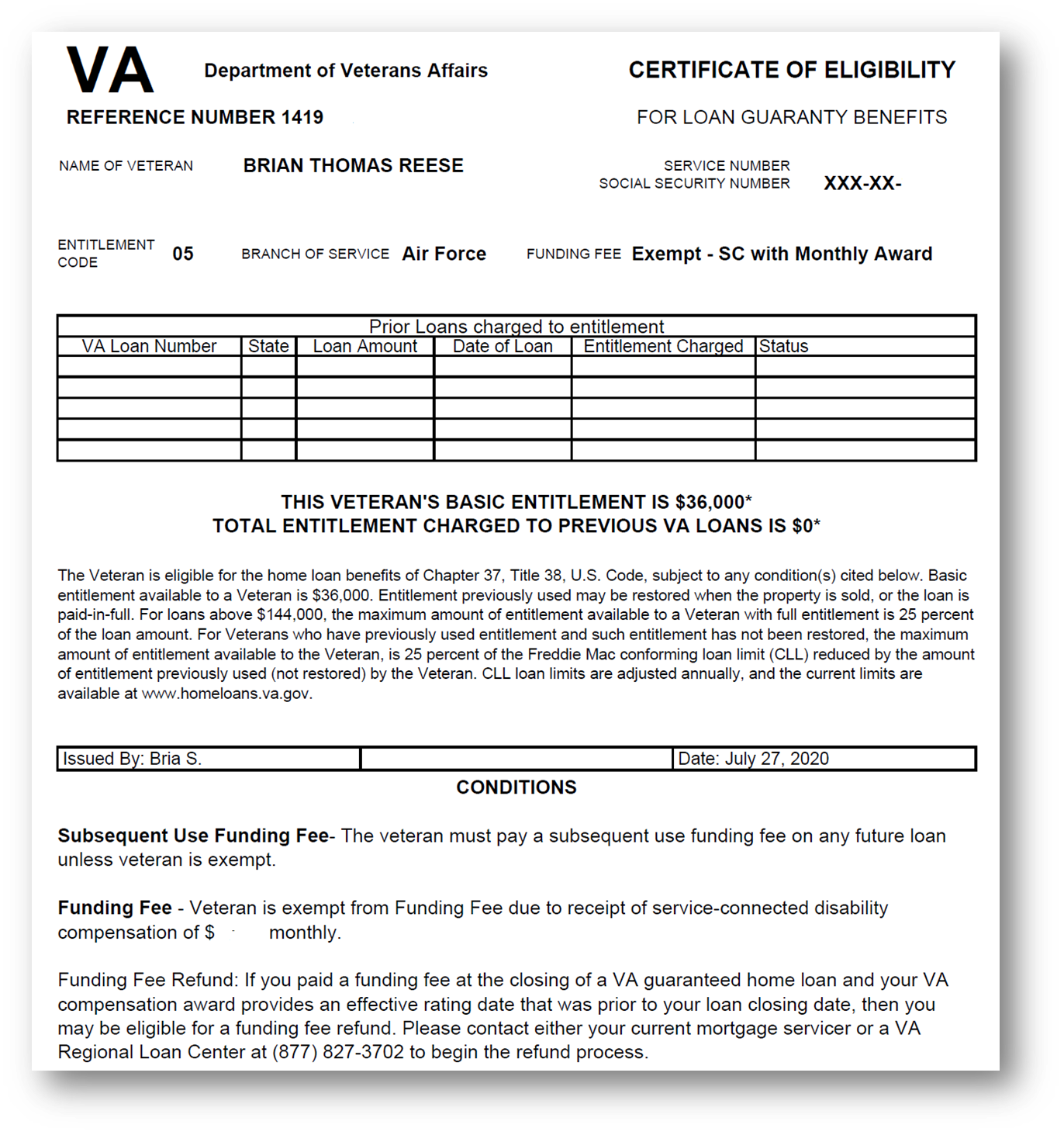

In this case, you restore your entitlement, but you can only do this one time. Below is an example of what your Certificate of Eligibility looks like. You need to know the “Total Entitlement Charged to Previous VA Loans” to properly calculate your bonus entitlement and maximum loan amount to buy another home with your VA home loan benefit.

Can A VA Loan Be Used to Buy a Second Home?

The full entitlement for a qualified borrower in this county would be $272,325 ($1,089,300 x 25%). For this example $500,000 purchase, you would need to come up with about $18,450 for a down payment because of your reduced VA loan entitlement. You could certainly aim for a bigger loan, but buyers who purchase above where their entitlement caps out must put down 25 percent of the difference between their cap and the purchase price. This article helped much in planning my finances as my husband and I plan to buy a second house. The most important thing I learned here about VA loans is that a considerable amount of time should be spent in the new house. I’m now wondering we should move to the new home for a while in order to make it eligible.

If you’re moving from a high-cost county to one with the conforming loan limit, you would be limited to a lower maximum entitlement. Continuing our example, let's say you have $75,000 in entitlement tied up in an existing property. That leaves you with $197,325 in remaining entitlement ($272,325 – 75,000). And that means qualified buyers could borrow about $789,300 in this high-cost county before worrying about a down payment. Because of this rule, it’s extremely important that you make sure your entitlement is restored if you sell your previous property.

Check VA Loan Eligibility

In order for a home to qualify as a primary residence, an owner needs to live in it at least 6 months and 1 day each year. If you do plan to buy a second home with remaining VA entitlement. It’s very important to make sure you understand how your remaining entitlement and local conforming loan limits interact. Loan limits don’t have any impact on a VA loan for someone who’s just trying to buy one house from meet VA policy standpoint. However, lenders can set their own policies and most have some special requirements if the loan amounts get high enough.

However, you cannot do so if your home was foreclosed on or if you have to surrender it in a deed in lieu of foreclosure. In order to get full entitlement restored, you do need to apply for it through the VA. One requirement that comes with VA loan on second home is that you must prove the second house provides you with a net tangible benefit. Remember that a big priority with VA loans is ensuring the borrower is always benefiting from the loan and any changes to it. A net tangible benefit might come from moving closer to your work or buying a second home for a spouse who lives out of the state.

Using a VA Loan for Investments

Entitlement protection encourages lenders to offer VA loans with lower rates, no down payment and easier guidelines to qualify. For example, as part of the VA loan application, a borrower must certify that he or she plans to move into the home being purchased within 60 days after the loan closes. However, it’s possible to get an extension beyond the usual 60-day limit for moving in. One example is when a home will get repairs or improvements that keep the veteran from occupying the property until work is completed. After moving within that 60-day period, the previous home can become the second home and the new home becomes the primary residence, meeting the occupancy requirement.

A deed of conveyance often has very similar documents to a title certificate (e.g., a certificate of title). You may need to submit an affidavit of attachment in some states for your manufactured home to be classified as real property. By refinancing an existing loan, the total finance charges incurred may be higher over the life of the loan. Please contact our support if you are suspicious of any fraudulent activities or have any questions. Veterans that assume the loan will need to use their own entitlement.

The VA loan can only be used for the purchase of a permanent residence. Consequently, vacation homes cannot be purchased with a VA loan. If two veterans decided to purchase the property together and use their eligibility to purchase it, they could purchase up to a 7-unit building. A significant advantage of using this type of structure is that it provides the owner with an additional income source or helps cover most of their mortgage payment. Many condos are eligible for the VA’s home loan programs, but not all. In this article, we’ll provide an overview on how to apply for a VA home loan for your second home, rental, vacation condo, or manufactured home.

In the case of the highest-cost counties, loan limits are set at the county level. If you’re not expecting to sell the house, you may keep it and rent it for the time being. You can find your remaining entitlement information on your Certificate of Eligibility .

Just because a VA loan is not available to purchase a second home, it does not mean it is off limits. There are some great second home loans available with as little as 10% down payment. Getting a VA cash out refinance on your primary residence could be a solution. Despite a great deal of confusion and misunderstanding, the federal government generally does not make direct loans under the act.

According to the VA, the home must be your primary residence, a property you “intend to personally occupy” as your home. The vast majority of people, including VA homeowners, would be wise to hold off on selling their home until they have developed enough equity in their homes to break even or produce a profit. It is likely that you will be able to pay off your mortgage, real estate commissions, and closing costs with the proceeds from the sale. You may be subject to capital gains tax if you sell your home within two years, regardless if it is VA-backed or not, and make a profit.

As a rule, lenders prefer a higher down payment for a second home compared to a primary residence. Even with a full entitlement, making at least a partial down payment may be necessary to qualify for a VA loan on a second home. At the very least, it improves your chances of getting a better interest rate. The VA has no minimum credit score for VA loan users, but many lenders do require higher credit scores for a second home compared to a primary residence.

In a purchase, veterans may borrow up to 103.6% of the sales price or reasonable value of the home, whichever is less. Since there is no monthly PMI, more of the mortgage payment goes directly towards qualifying for the loan amount, allowing for larger loans with the same payment. In a refinance, where a new VA loan is created, veterans may borrow up to 100% of a property's reasonable value, where allowed by state laws. In a refinance where the loan is a VA loan refinancing to VA loan , the veteran may borrow up to 100.5% of the total loan amount. The additional .5% is the funding fee for a VA Interest Rate Reduction Refinance. You may also qualify for an additional or secondary mortgage if your first property was financed using VA loan benefits.

How Does LendingTree Get Paid?

Because the $250,000 house you are thinking of buying is less than the $310,400, you would not be required to make a down payment. Next, you subtract the amount of entitlement you’ve already used from the maximum guarantee to determine how much bonus entitlement you have left. First, multiply the local loan limit by 25% to get the maximum VA guarantee. Imagine you buy a $200,000 home, using $50,000 of your entitlement. But you'd still have $77,600 in second-tier entitlement left over.

No comments:

Post a Comment